Protect uptime of critical insurance systems and services

Keep core systems fully operational to uphold customer confidence, safeguard revenue, and comply with regulatory requirements.

Secure policyholder loyalty and prevent processing delays

Build customer trust by turning IT noise into insights with AI-driven incident analysis, ensuring reliable services for faster claims and policy responses.

Deliver reliable insurance services

Maintain dependable uptime of critical insurance and payment services and systems at scale. Enhance alert actionability with a unified incident view, enabling faster resolution, better SLA adherence, and reliable availability across hybrid IT.

Cultivate lasting customer loyalty

Trust is everything when customers face an insurance crisis. Leverage AI-powered analysis to triage incidents with automated impact, priority, and assignment suggestions—enriching end-user tickets and resolving issues before disruptions to claims or self-service portals occur.

Achieve scalable incident management

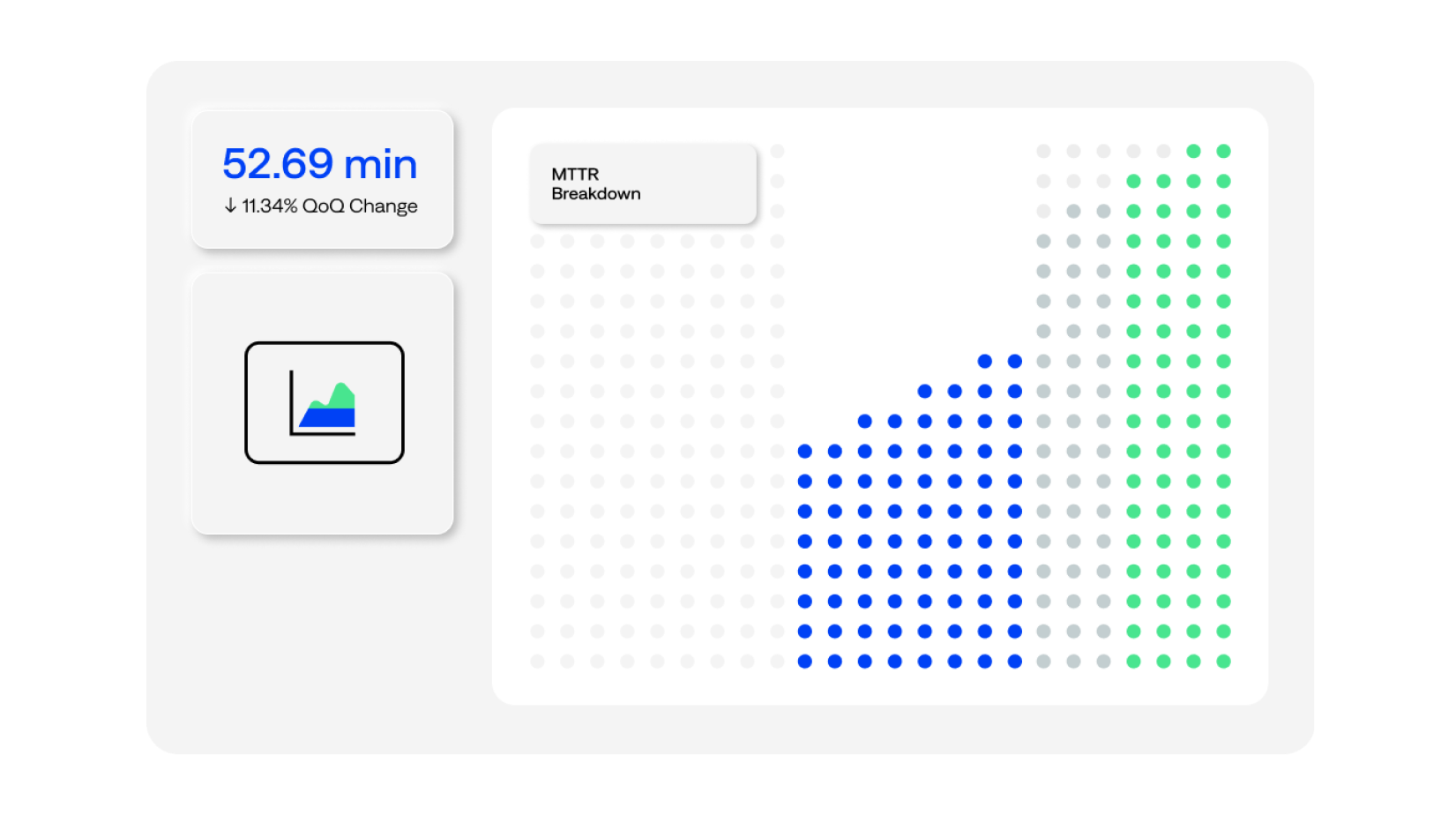

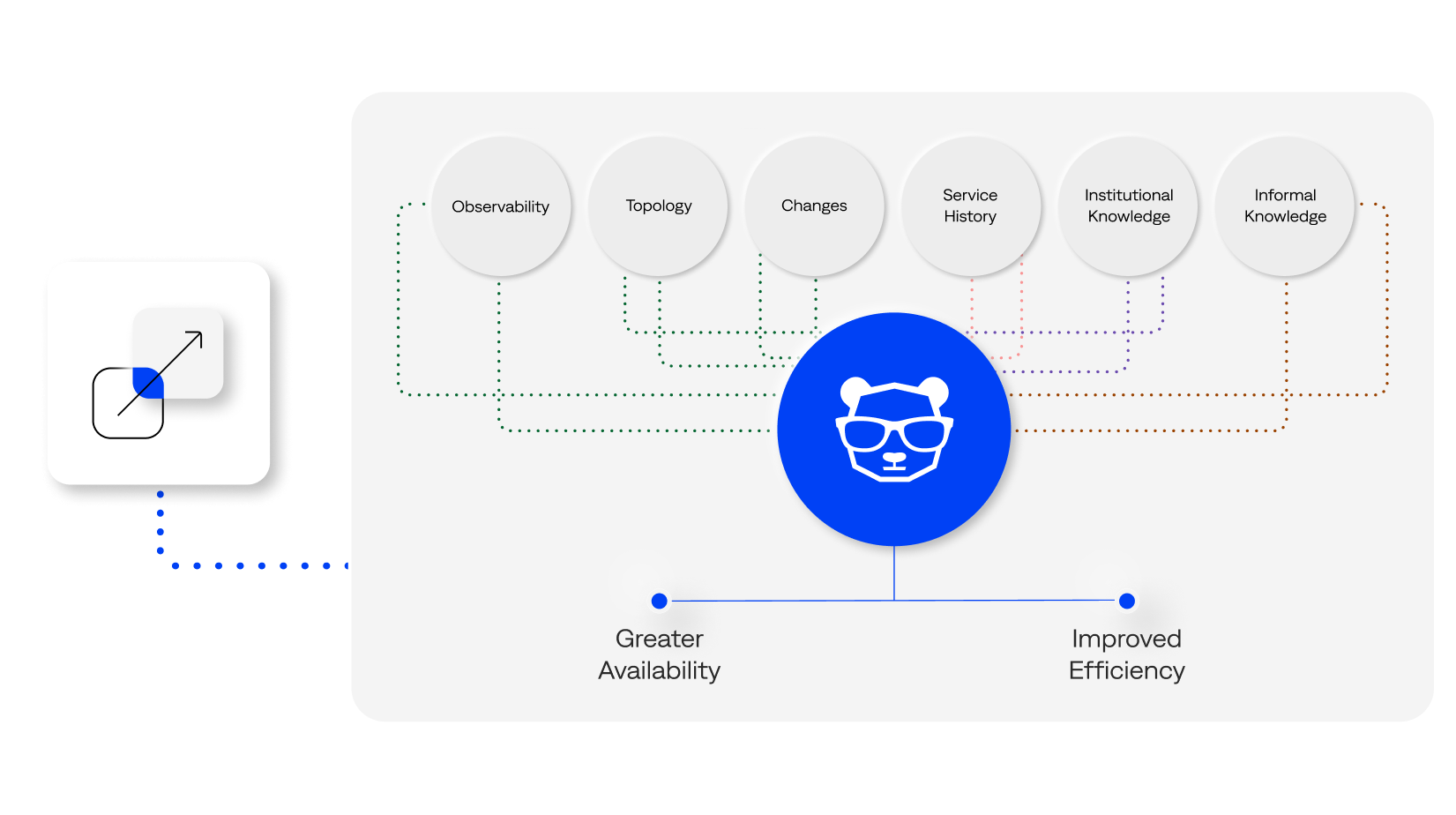

Leverage an agnostic, unified view of your expansive insurance service offerings by integrating siloed data and institutional knowledge into normalized, context-rich insights. Enable comprehensive situational awareness for optimized workflow efficiency and cost-effective operations.

Prevent regulatory penalties and fees

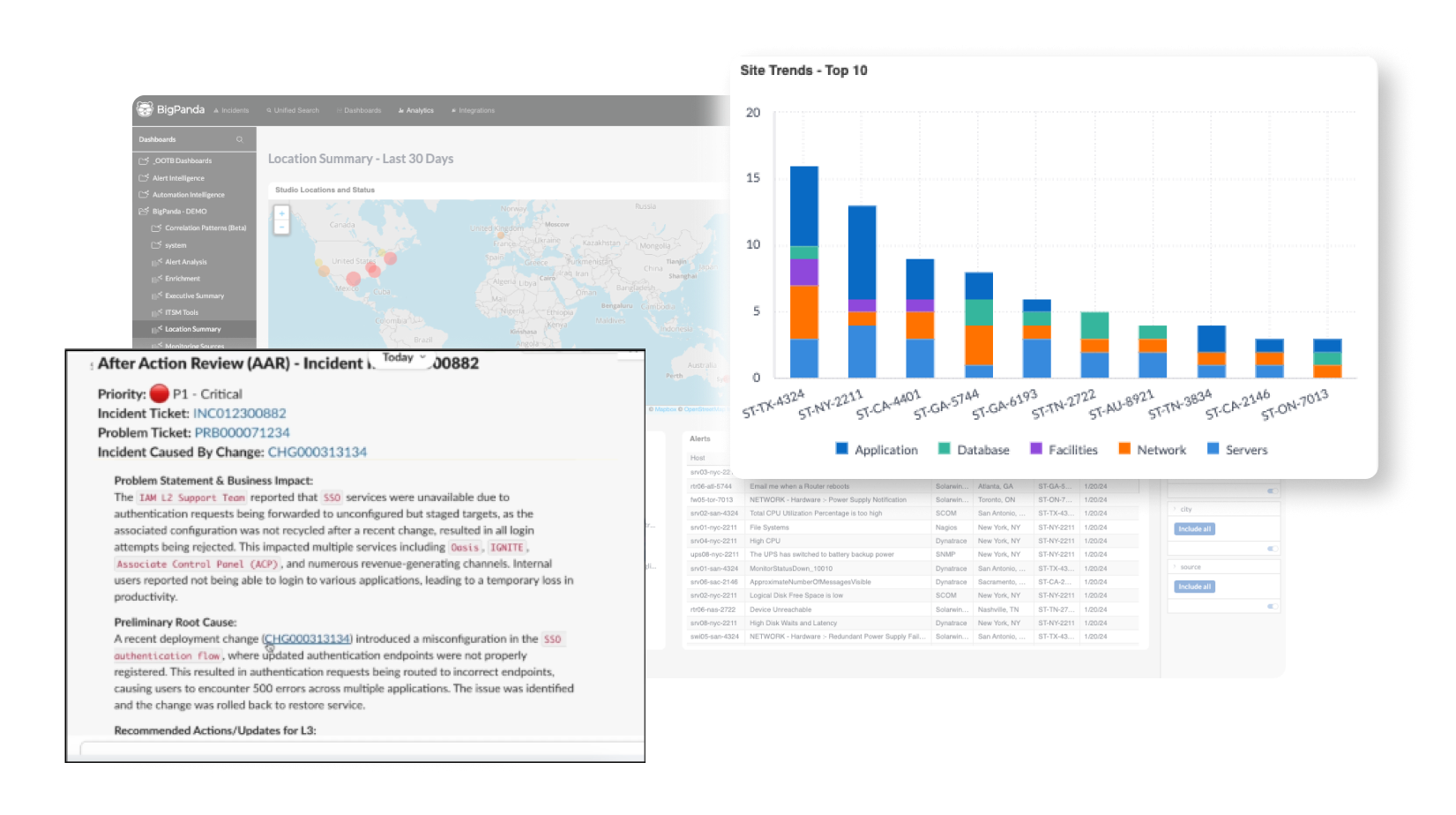

Automated incident summaries and postmortem analysis create comprehensive logs and audit trails, supporting compliance reporting and tracking. Customizable dashboards unify data, refine alerts, and filter noise across hybrid environments to prevent customer-impacting incidents and mitigate regulatory risks.

Modernize IT visibility and automation

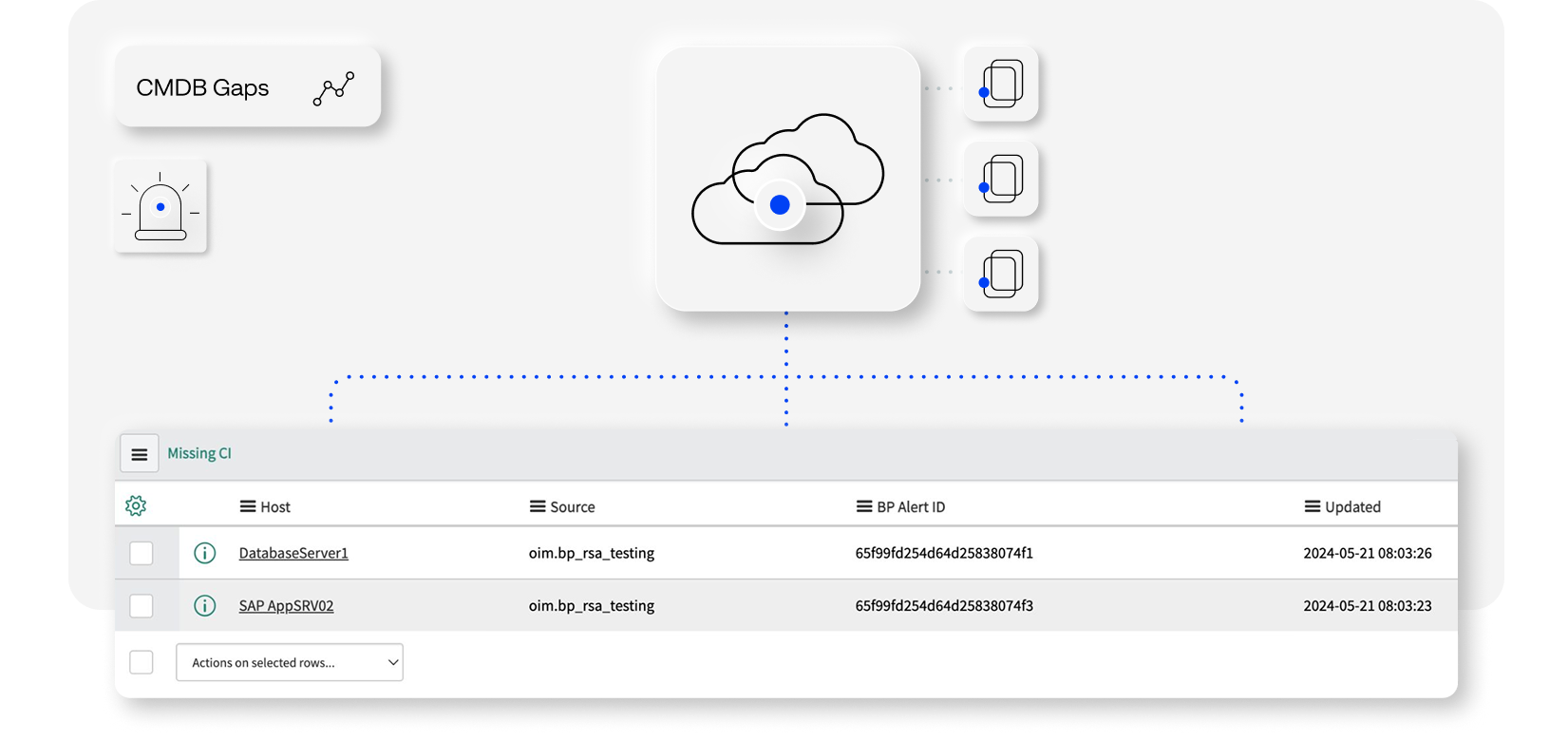

Merge data from member portals, provider networks, claims systems, and more to bridge CMDB gaps, enhance ITSM, and drive digital transformation. Automate configuration management, reporting, and CI discovery while accelerating issue resolution to prevent customer impact.

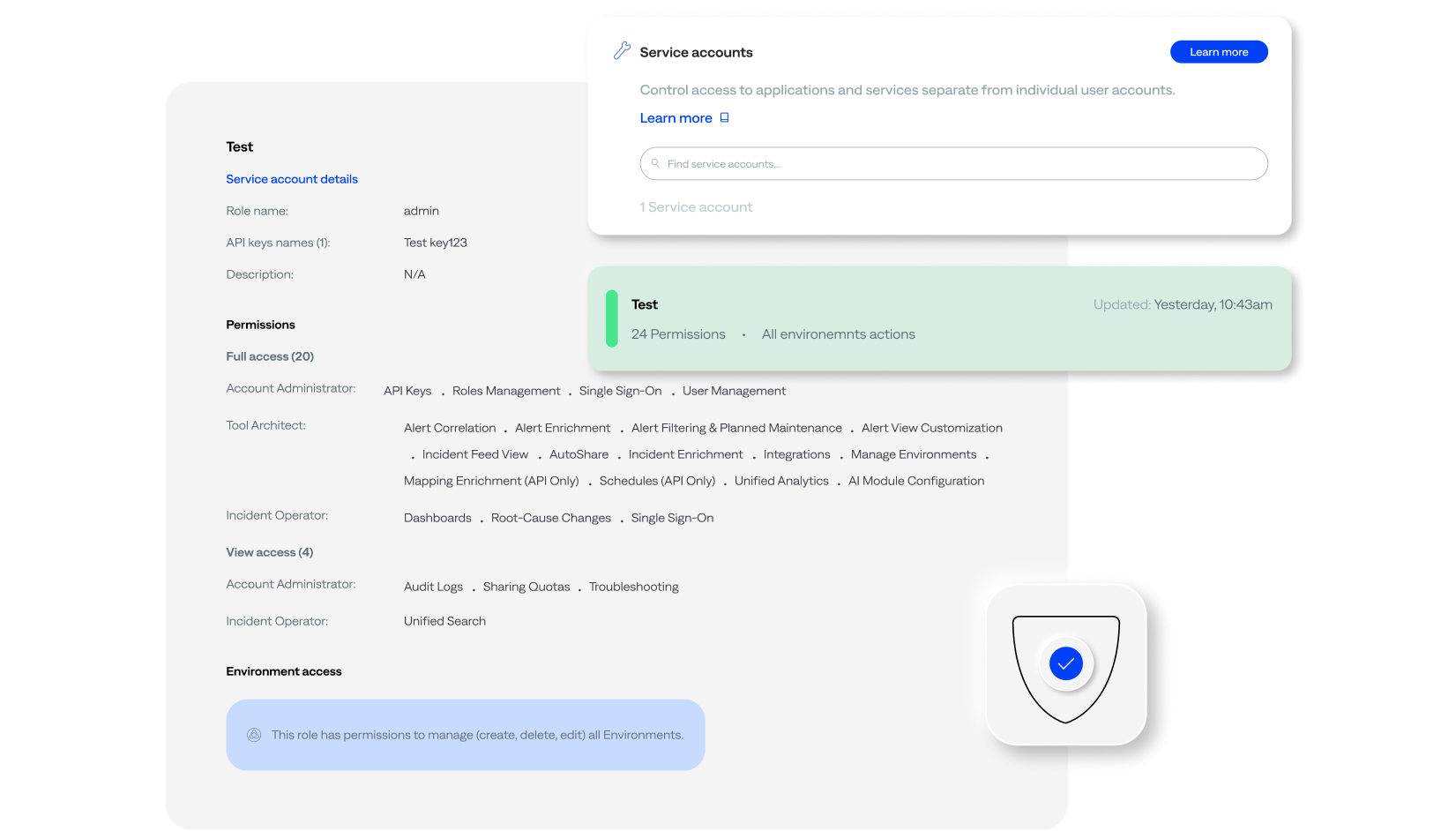

Ensure secure access management

Streamline access control with industry-standard security protocols. Customize granular permissions, automate user provisioning, and integrate with identity providers (IdPs) like Okta and Azure to safeguard data with encryption and SSO authentication, ensuring security across transmission, storage, and processing.

Agentic ITOps Platform

From firefighting to prevention: transform IT incident management with agentic IT operations

The power of AIOps for insurance

“We’ve automated an average of 83% of alerts that come into BigPanda. Meaning the bulk of our alerts now get resolved automatically or receive a ticket without our team having to manually investigate it from beginning to end.”

FAQ

How does AIOps improve service availability for insurance providers?

BigPanda AIOps centralizes situational awareness across hybrid environments, enabling ITOps teams at health, property, and casualty insurers to quickly assess incident priority, impact, and assignment. By proactively resolving IT issues, insurers can prevent claims processing delays, policy management disruptions, and agent portal outages, ensuring uninterrupted service for policyholders and providers while maintaining regulatory compliance.

How does BigPanda automate workflows?

BigPanda Workflow Automation automates time-consuming tasks like notifications and ticketing to streamline incident response. BigPanda integrates with IT Service Management (ITSM) and ticketing tools to automatically identify high-quality incidents, update tickets, and trigger automated runbooks, enhancing existing workflows.

Does BigPanda work across hybrid systems?

BigPanda supports both on-premises and cloud-based workloads and integrates with various monitoring and observability tools. The BigPanda Open Integration Manager facilitates custom integrations as well. BigPanda unifies on-premise and cloud topologies to provide comprehensive visibility across environments, identify improvement opportunities, and enhance digital transformation efforts.

How can generative AI improve IT operations and IT incident response?

BigPanda uses GenAI to automatically analyze and summarize incidents, identify patterns, and suggest root cause in real time. BigPanda Biggy AI helps ITOps, Incident Management, and L2/L3 teams make smarter, faster decisions, improve productivity, and scale incident management.

Check out more related content

On-Demand Webinar

Unleashing Agentic IT Operations

Explore the vision behind our agentic IT operations platform—built to help enterprises automate ITOps and incident management.